On 28 December 2017, the Company announced that it had entered into a Definitive Agreement with Pan American Silver Corp to acquire the Calcatreu Deposit for a total consideration of US$15 million. Patagonia Gold has made the initial payment of US$5 million with the balance of US$10 million paid on 18 May 2018. As a result of the transaction, Patagonia Gold, through a wholly-owned subsidiary, has acquired Minera Aquiline Argentina SA which owns 100% of the Calcatreu Deposit.

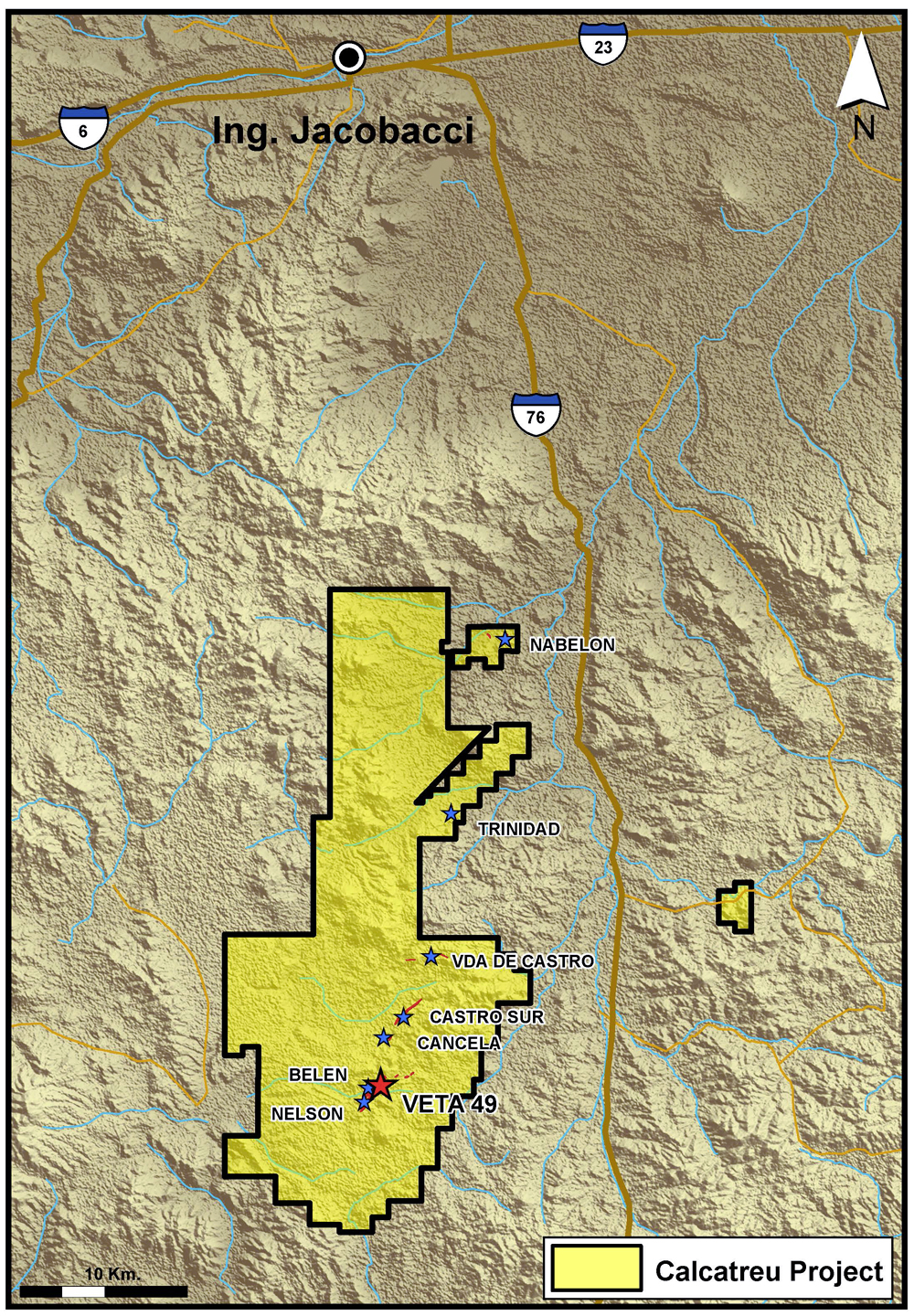

The project is located about 40 kms south of the community of Jacobacci.

Geology and MineraliZation

The Calcatreu Deposit is a high-grade (2.325 g/t AuEq) low sulfidation gold system with the mineralization outcropping at the surface.

An updated mineral resource estimate was prepared by CUBE Consulting Ltd of Australia prepared an updated JORC/NI 43-101 compliant resource estimate for the Calcatreu project, with effective date of 31 December 2018., on file at www.sedar.com (please see the table of mineral resources in the Operations section of this website).

The Company believes an opportunity exists to convert a portion of the existing inferred resources into a higher category through additional drilling and studies to elevate the current level of confidence in the interpretation. The surrounding land package has over 90,000 hectares of sparsely explored terrain.

Work to Date

The Company initiated exploration work at Calcatreu shortly after acquiring the project. The 2018 exploration program consisted of a 30-line km Pole-Dipole induced polarization/resistivity (“IP/Res”) geophysics survey, mapping, and geochemical sampling program. Further diamond drilling was conducted in 2018, which focussed on testing geophysical anomalies at several targets along strike from the main gold-silver mineralization trends at Calcatreu. In conjunction with ongoing geophysical surveys, the exploration team will be carrying out updated field reconnaissance and mapping study and geochemical rock chip sampling for the remainder of the land package. Calcatreu will be the primary exploration focus for the Company during 2019.