Following the cessation of mining operations at the Cap-Oeste open pit in July 2018, Patagonia Gold continues to recover precious metals from residual leaching and is now focused on evaluating the development of the higher-grade component of the total mineral resources, termed the “COSE-Style zone, which contains approximately 300,000 oz AuEq at 19 g/t AuEq.

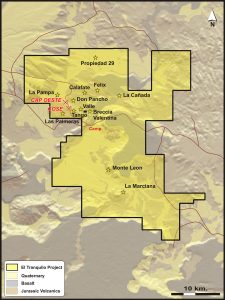

The Cap-Oeste Project is located within a structural corridor extending six kilometers from the La Pampa prospect in the northwest to the Tango prospect in the southeast. To date, the Cap-Oeste deposit has an identified and delineated strike extent of 1.2 kilometers.

Cap-Oeste Resource

Current pit operations have now advanced to a level where high-grade COSE style hypogene mineralization has been exposed enabling the Company to confirm the shoot’s dimensions, style of mineralization and grade below the current pit. A subsequent reinterpretation of the deeper drilling and mineralization intersected below the current pit has led to a material increase in the tonnage and contained gold and silver of this non-refractory style of mineralization.

An updated mineral resource estimate was completed by CUBE Consulting and disclosed in a 2018 NI 43-101 technical report. The total, measured and indicated mineral resources, includes a high-grade zone below the current pit, termed COSE-style mineralization, of approximately 478,000 tonnes at an average grade of 19.4 grams per tonne (g/t) and 298,000 contained AuEq ounces. This material is amenable to standard cyanide extraction.